Down massively from their highs, these underappreciated stocks look like great buys.

Macroeconomic challenges have reshaped the way the market is thinking about growth stocks. Despite what recent performance might suggest, some stocks that are down more than 80% from their highs are actually backed by promising companies with serious rebound potential. Putting your investment dollars behind the best of them could be a path to stellar long-term returns.

Here’s why investing in these three beaten-down stocks could be a great move to start the new year.

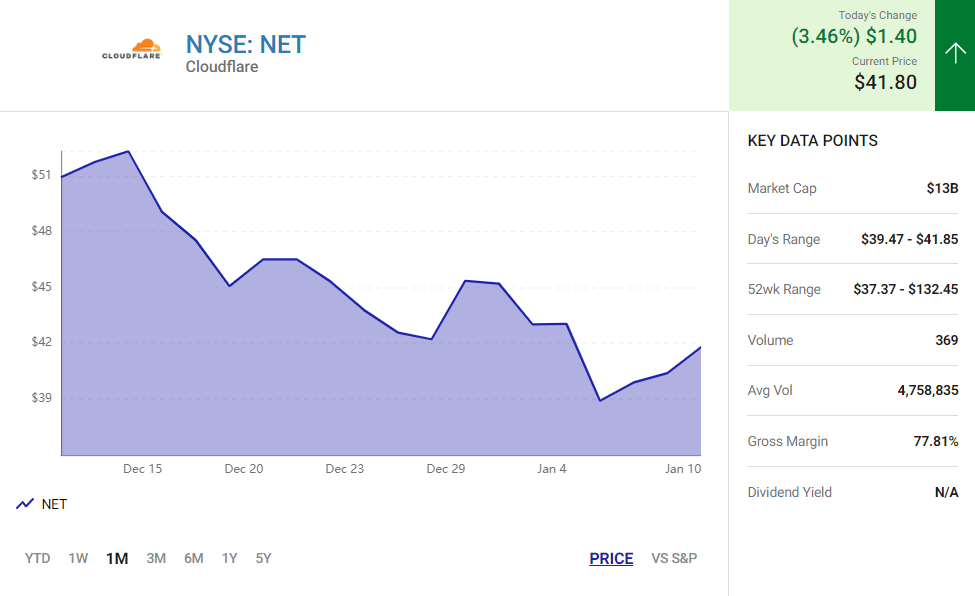

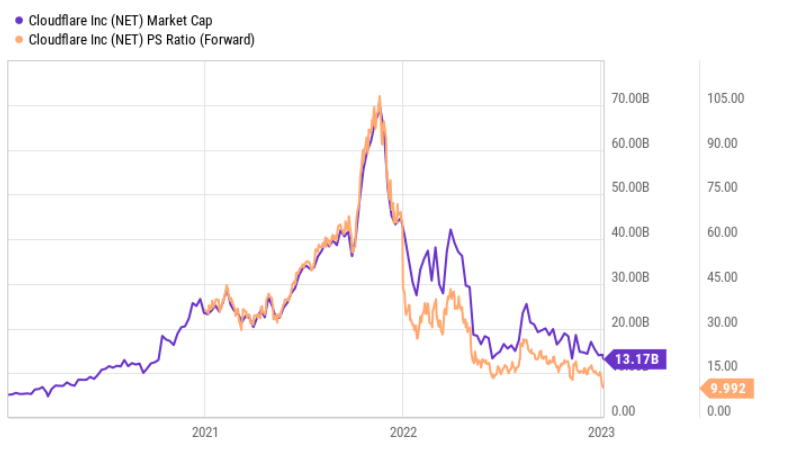

1. Cloudflare

Cloudflare (NET 3.46%) is the world’s leading provider of protection against distributed-denial-of-service (DDoS) attacks. Without these kinds of technologies, bad actors can flood servers with a barrage of access requests that results in a shutdown. The company also provides content-delivery-network (CDN) services that use edge computing to speed up the rate at which information can be sent and received around the globe.

The company ended the third quarter with 1,908 customers generating more than $100,000 in annualized sales, up from 451 in the third quarter of 2019 and good for a compound annual growth rate of 61% over the last two years.

Cloudflare posted a net revenue retention rate of 124% in the third quarter, which means that existing customers increased their spending on its services by 24% compared to the prior-year period. That’s a strong indication that customers are getting great value from the company’s software, and the web services specialist has been having plenty of success attracting new customers as well.

Amid dramatic valuation pullbacks for growth stocks at large, Cloudflare stock now trades down roughly 81% from its all-time high. With the company sporting a market capitalization of roughly $13.2 billion and trading at approximately 10 times this year’s expected sales, the company still has a growth-dependent valuation that could set the stage for more volatility in the near term, but the stock looks poised to be a big winner for long-term investors.

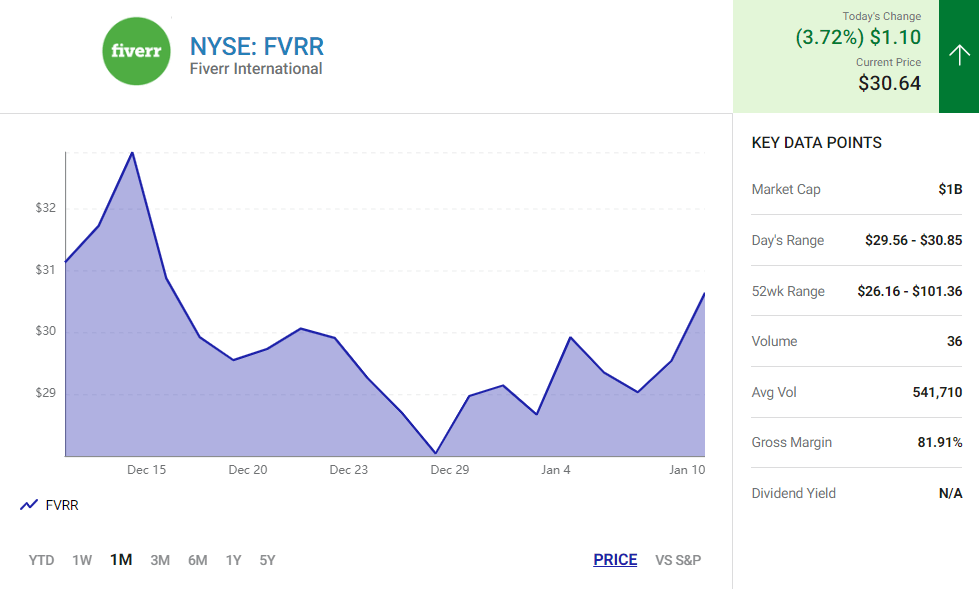

2. Fiverr International

Fiverr International (FVRR 3.72%) operates a marketplace that connects freelance workers with those looking to hire contractors. With the coronavirus pandemic briefly shuttering many offices and then spurring the adoption of increased work-from-home operations, the company’s platform enjoyed surging demand — and its share price was bid up to dizzying levels. Now, the economic backdrop has shifted, and the gig-labor specialist has seen slowing sales growth and a dramatic pullback in its valuation.

While Fiverr’s third-quarter year-over-year revenue growth of roughly 11% came in far below the rates of expansion it had posted in preceding years, the company still managed to maintain positive momentum along key metrics.

The number of active buyers on its platform increased 3% compared to the prior-year period to reach 4.2 million, and average spending per buyer increased 12% year over year. The company’s take-rate, which is a measure of how much the company takes from each job completed through its platform, also hit 30% — up from 28.4% in the prior-year period.

The company also recorded an 81.1% gross margin in the quarter, down from 83.3% in Q3 2021 but still quite impressive in its own right. Non-GAAP (adjusted) earnings per share also rose roughly 9.5% year over year to reach $0.23.

Despite probable continued economic slowdown in the near term, the gig economy looks poised for long-term growth — and Fiverr is on track to play a key role in its evolution. With the stock down roughly 91% from its high, Fiverr could go on to be an explosive winner for patient investors.

3. Roku

Roku (ROKU 4.27%) is another stock that saw a huge valuation run-up driven by pandemic-related conditions. In addition to the low-interest rate environment that helped bullish momentum for growth stocks, the streaming-technologies company benefited from social-distancing and shelter-in-place conditions, causing people to spend extra hours indoors streaming their favorite shows and movies. But those tailwinds have now receded, and Roku stock trades down 91% from its peak valuation level.

With the company’s market capitalization pushed down to roughly $5.8 billion, Roku is now valued at just 1.8 times expected forward sales.

Admittedly, the multiple contraction isn’t entirely unwarranted. After growing sales 51% year over year in Q3 2021, revenue growth in last year’s quarter came in at a much less flashy 12%.

While Roku’s growth has decelerated significantly, the company still managed to increase average revenue per user roughly 10% year over year in the third quarter, and there are other signs that the company’s long-term growth story is far from over. Roku recently announced that it had reached more than 70 million global active accounts, and it should be able to persevere despite facing a more challenging advertising market in the connected television space.

With macroeconomic headwinds on the horizon, Roku probably won’t be posting meaningful profits in the near future, but the company has a sturdy balance sheet, with roughly $2 billion in cash and equivalents and no long-term debt. While the streaming player is facing a combination of macro headwinds and competition across multiple levels of its industry, Roku has a strong installed base and solid engagement numbers.

Source: nasdaq.com