While 2022 was a year for stock price corrections across the electric vehicle (EV) sector, 2023 looks to be a transition year for the businesses themselves. EVs are going mainstream as manufacturers across the globe are ramping up production.

EVs made up 10% of all new cars sold globally last year. Europe and China are leading the way, with fully electric vehicles accounting for 11% and 19% of all new vehicles sold, respectively. With stock prices down and sales continuing to pick up, investors should look at investing in a diverse mix of EV makers in 2023.

Results matter, not expectations

Tesla (TSLA -0.59%) is starting out 2023 proving that it remains the industry leader. It is so far ahead of the competition that it almost has to have a place in any basket of EV holdings. Even after a small recovery to start 2023, Tesla shares are still down almost 60% over the past 12 months.

But Tesla’s business remains strong. Maybe not as strong as some analysts and investors hoped, but that’s why the shares have become much more reasonably priced. Some feared Tesla’s vehicle price cuts across its sales regions indicated a drop in demand that signals a slowing business. But investors should look at results, and not just what prior expectations from analysts have been.

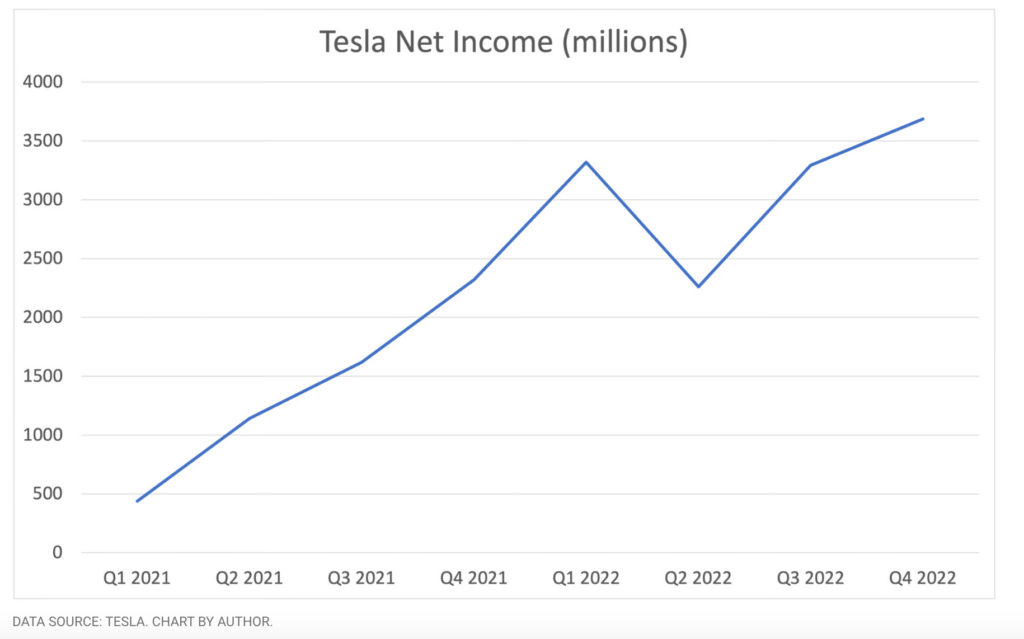

Increasing competition, and the resulting decrease in its market share, were inevitable. But Tesla generated $7.6 billion in free cash flow in 2022 even as it continues to invest for growth. The fourth-quarter results it recently released show its strategy to lower prices as much as 20% is one where it can still be a very profitable, high-growth business. Even with headwinds and price cuts in China, Tesla’s net income continued to grow in the fourth quarter.

Its strategy is to attempt to hold market share and deliver high volumes of vehicles. Even as its margins slide somewhat, Tesla will have those customers and potentially be able to upgrade those units with higher-margin automation in the future. It’s still a long-term growth story one should own.

Invest in the biggest markets

One company that is working to battle Tesla for market share in the biggest global markets is China-based Nio (NIO -3.74%). Nio boosted production, launched new models, and gained traction in the European market in 2022. The company is now squarely embedded in the two biggest global automotive markets.

Nio is a much more speculative investment than Tesla, though. Nio shares are also down about 60% over the last year, but unlike Tesla, it has yet to make a profit. Due to rising costs and production delays from COVID-19 impacts in China in 2022, the company reported a net loss of almost $1.3 billion in just the first nine months of the year. But growth is still accelerating for Nio, and total revenue is expected to be about $7.5 billion from 2022 sales.

With the stock’s decline over the course of the company’s struggles last year, its valuation has reached a reasonable level for a speculative investment. Nio’s price-to-sales (P/S) ratio is now below 3.0, which is less than half that of Tesla. That makes it an intriguing addition to a mix of EV stocks to buy in 2023.

True diversity

Ford (F -1.62%) could also be a good addition to that mix. It not only is quickly growing sales of its brand new lineup of electrified vehicles, but it also offers real diversity in a mix of EV names. That’s because Ford doesn’t intend to end sales of its internal combustion engine vehicles. Its initial electric offerings are also a mix of the Mustang Mach-E SUV, F-150 Lightning pickup truck, and E-Transit commercial van.

The F-150 Lightning has been named the MotorTrend Truck of the Year for this year, and interest is booming. It launched in May and has already become the best-selling electric truck in the U.S. Valuation certainly isn’t a disincentive to own Ford. It sports a P/S ratio of just over 0.3, or about one tenth that of Nio. Ford still needs to show it can earn a profit on its electric offerings, but considering the diversity it already offers, it also makes a good addition to a small basket of EV stocks worth buying in 2023.

Source: fool.com