The green transition could spur huge economic gains as the world looks to curb climate change, a new report finds.

A study from Oxford Economics and Arup estimated that green industries could add $10.3 trillion to the world’s economy — or 5.2% of global GDP — by 2050 under a net-zero scenario.

The report made the case that governments and businesses, under increasing pressure from costly climate-related weather events, may begin to see a rapid transition away from fossil fuels as a net positive as well as a way to avoid climate disruptions.

“Fear is a compelling reason to act on climate change, but we believe human ambition can be another critical driver of environmental action,” Brice Richard, global strategy skills leader at Arup, wrote. “This report shows the green transition is not a burden on the global economy, but a substantial opportunity to bring about a greater and more inclusive prosperity.”

There are three reasons why a green transition could add sizable value to the global economy, the report found. First, the switch to clean energy will create new areas of competition. Second, green markets will emerge. And third, the world could benefit from higher productivity relative to a scenario in which insufficient action is taken on climate change.

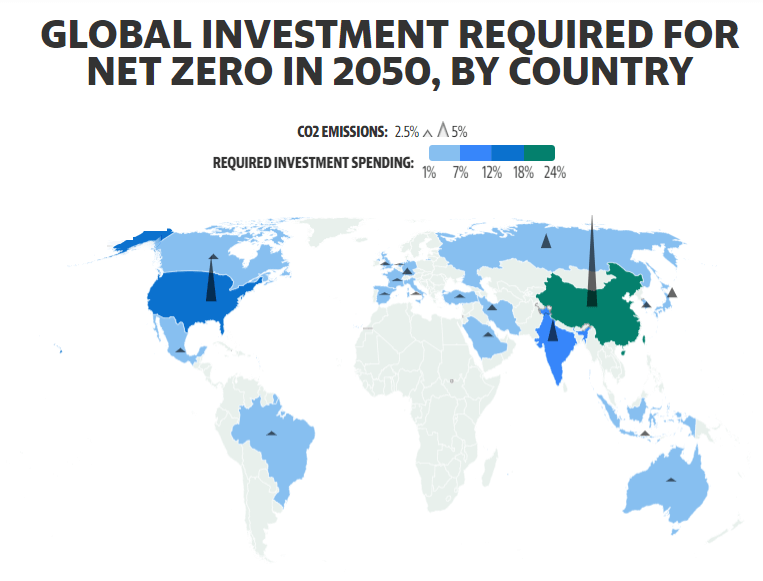

However, realizing that $10 trillion requires that governments enact measures to incentivize private-sector investment such as research tax credits and co-financing. It is estimated that hundreds of trillions of dollars in public and private capital will need to be deployed to reach net zero.

“As economists, we have to be honest about the fact that mitigating climate change will be expensive,” Oxford Economics CEO Adrian Cooper said in a statement. “But the transition to a carbon-neutral global economy also presents compelling opportunities.”

Currently, just 16% of climate investment needs are being met, according to the Rockefeller Foundation. That gap in investment has also meant that, so far, the world is falling short of its pledges to cut carbon emissions and limit climate change.

The scenario in which the world generates $10 trillion from green industries is one in which the world reaches net zero by 2050, a goal set out in the Paris Agreement to keep global heating to 1.5 degrees Celsius by the end of the century.

Current policies put the world on track to warm by 2.6-2.9 degrees Celsius by 2100, relative to pre-industrial levels. When factoring in current pledges made by countries, it puts the earth on a pathway of 2 degrees of warming.

‘A new competitive landscape will emerge’

With the transition underway, industries could unlock returns by investing in green infrastructure, renewable energy, and talent pools, which may also cut costs and reduce risk over the long term. Companies catering to changing consumer demand for more sustainable products may also benefit.

Yet, capturing that first-mover advantage could also be costly in the near term through the purchase of new equipment and training workers.

“The transition will be costly and painful for certain enterprises, industries, and economies,” the authors wrote. “But in a transition to a net zero emissions environment by 2050, under a rapid transition away from carbon-intensive activities, a new competitive landscape will emerge. In many sectors, this requires a fundamental shift to consuming renewable fuels and energy. In others, new green equipment and technology will be needed in production. All sectors will experience short-term costs but the chance of earning large rewards over the medium- and long-term horizons.”

At the same time, new markets will emerge that could become engines of economic growth.

Electric vehicles, for instance, represent a $3.4 trillion opportunity by 2050, the report found. Specifically, the authors noted that EV production — which includes motorbikes, cars, and industrial vehicles — will contribute $1.47 trillion by 2050 while the supply chains for these manufacturers will add $1.87 trillion by that year.

Other new markets include renewable electricity production (worth $5.3 trillion by 2050), renewable fuels ($1.1 trillion), clean energy equipment ($316 billion), and green finance ($90 billion).

Different countries will need to play to their strengths to reap rewards from the green transition, and in some cases, advantages will be found in more niche markets with fewer competitors. For example, Singapore has capitalized on sustainable food production while Indonesia has been experimenting with battery-swapping technology for electric bikes.

“There will be fortunes made, crudely, solving these problems,” Will Day, fellow at the Cambridge Institute for Sustainability Leadership, wrote. “There will be fortunes lost by those who don’t understand the context and don’t invest wisely or stay too late.”

Source: finance.yahoo.com