Bet the farm on battered Tesla (TSLA) stock ahead of the company’s hotly anticipated earnings report on Wednesday, contends Canaccord Genuity analyst George Gianarikas.

“Buy [Tesla stock] — it’s pretty simple,” Gianarikas said. “The stock had a pretty bad 2022 in terms of performance. That was based on multiple things, and some would attribute it to Elon Musk’s rantings on Twitter. We think it had a lot to do with the demand situation impacting Tesla, first in China and later kind of leaking into other parts of the world, including the United States. People know that. A lot of that seems to be priced into the stock.”

The bullish call on Tesla — which has become a rarity in recent months on the Street — runs counter to a host of red flags on the automaker’s fundamentals.

Tesla reported a delivery growth figure of 39% for 2022, which badly missed analyst estimates and fell below the company’s own guidance of 50%.

And earlier this month, Tesla cut the price of the Model 3 base version by $3,000 to $43,990 and the Model 3 Performance version by $9,000 to $53,990 in the U.S. As for the Model Y Long Range, the price dropped by $13,000 to $52,990 while the Performance model was cut to $56,990, about $13,000 cheaper than the prior price.

The U.S. discounts come hot on the heels of recent price reductions in China, Japan, and South Korea as Tesla looks to reignite demand against growing competitive threats.

Gianarikas said he believes the price cuts will stoke demand, even if it weighs on profit margins. The analyst is also bullish on the margin lift to Tesla from selling more software upgrades to customers.

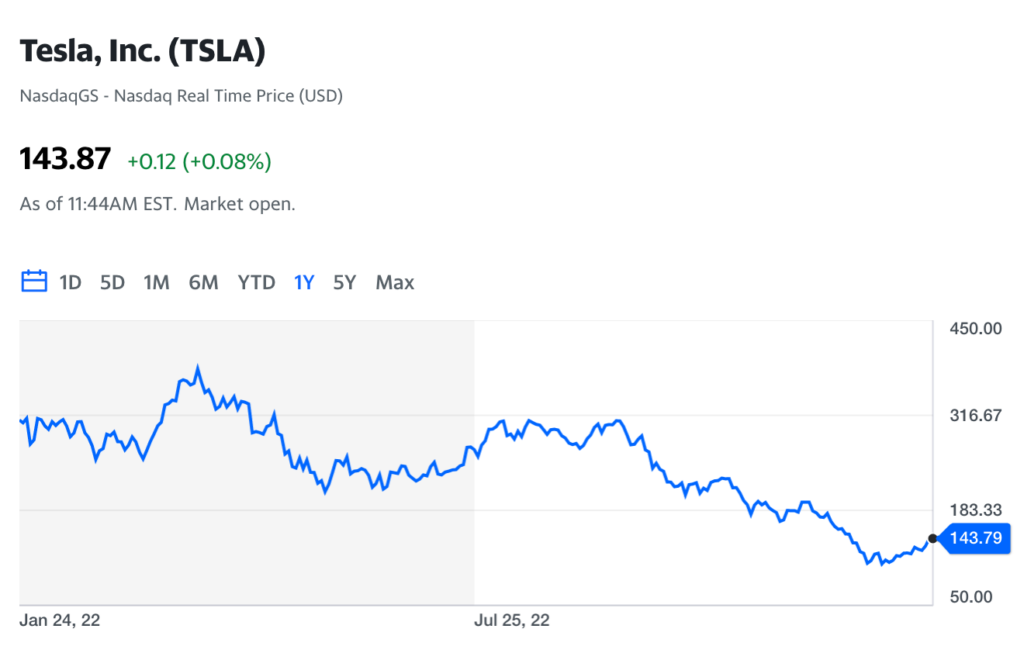

Still, Tesla stock has plunged 54% over the past year, not helped by Elon Musk’s chaotic tenure as Twitter’s owner.

“Very simply, this is a fork-in-the-road year ahead for Tesla that will either lay the groundwork for its next chapter of growth OR continue its slide from the top of the perch with Musk leading the way downhill,” Wedbush analyst Dan Ives said in a more bearish note to clients this month. “Now is a time for leadership from Musk to lead Tesla through this period of softer demand in a darker macro and NOT the time to be hands-off, which is the perception of the Street.”

Source: finance.yahoo.com