Powerful executives running public companies are collectively doing a great job at 1) worrying investors about the path forward for profit and cash flow growth this earnings season; and 2) managing expectations so their business could potentially beat earnings estimates even if the U.S. enters a mild recession in 2023.

And if CEOs sound dreary on earnings calls this reporting season, it’s probably because they have a lot of concerns on their minds.

According to a recent Conference Board survey, “the number one concern for CEOs around the world is the economic downturn and recession.” Inflation – also no friend to the top and bottom lines – comes in second.

“What we are hearing from retailers is better than what we heard in the fourth quarter, but it does vary through retailers,” XPO CEO Mario Harik said. “On the industrial side, quite a bit of strength.”

PepsiCo CFO Hugh Johnston told that he wouldn’t be surprised if there was a mild recession in the U.S. this year.

“Frankly, we are coming out of 2022 which was just an outstanding year,” Johnston explained. “I mean, 14% revenue growth, strong EPS. Obviously, the company is just firing on all cylinders. We have good momentum coming into the year, but we are also aware of the fact in a high-interest rate environment it could start to drag at some point.”

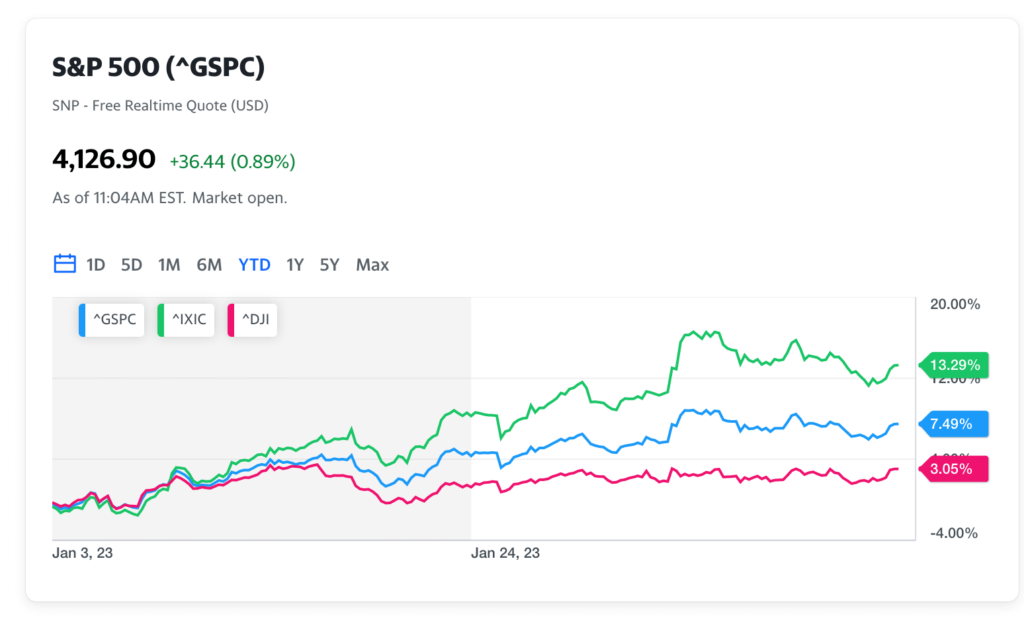

Amid the cautious C-suite talk and relatively weak earnings growth, the S&P is up about 6.5% so far in 2023 the year and the Nasdaq is up nearly 12%.

Corporate America may be on to something, however. If we are not at the beginning of a new bull market, then we could be in for a rude awakening at some point in 2023.

“I think at some point we are going to break last year’s lows on the S&P 500 and Nasdaq,” Academy Securities strategist Peter Tchir told. “In particular the Nasdaq, we are going to go through that because everyone got bullish again and we are going to realize oops, this is not as good.”

Happy Trading!

Source: finance.yahoo.com