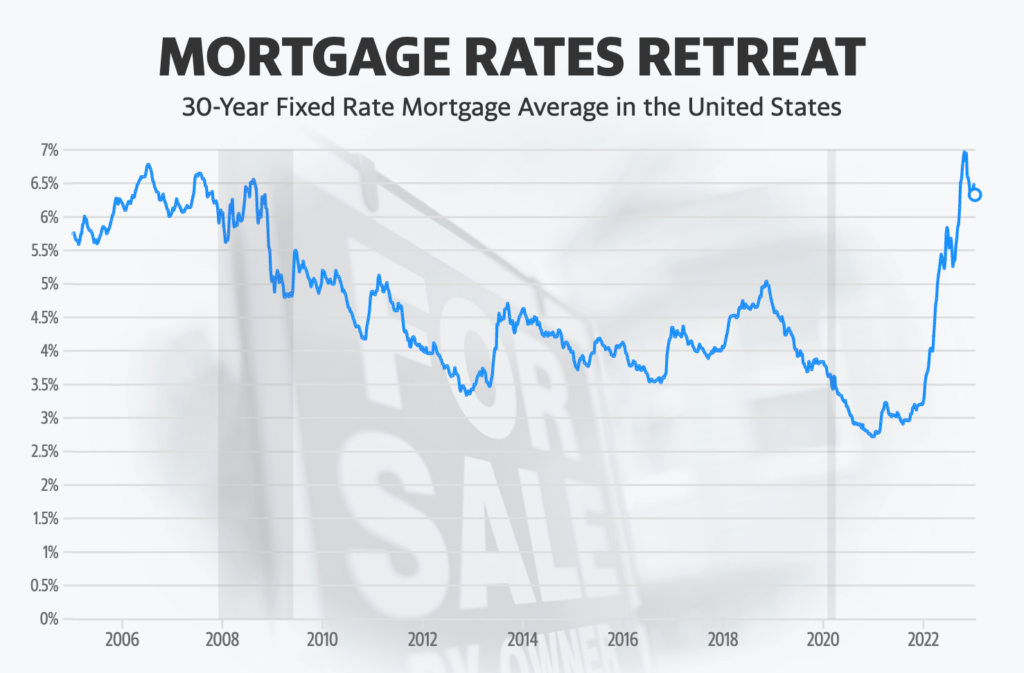

Homebuyers may finally catch a break this year, says one expert, as signs of fading inflation could drive mortgage rates lower as soon as this month.

“Mortgage rates have declined by almost a full percentage point since they peaked in November,” told Melissa Cohn, vice president for William Raveis, a real estate brokerage firm. “I think that we can expect mortgage rates to go down another quarter or even as much as a half a percent over the course of the next month.”

The average interest rate on the 30-year fixed mortgage has fallen by three-quarters of a percentage point since mid-November, according to Freddie Mac, hitting 6.33% this week. The decline in rates comes after a series of government reports showed signs that inflation in the U.S. was finally cooling.

For some buyers, a mortgage rate drop means gaining back purchasing power and re-entering the market.

“It’s the beginning of 2023. Everyone is back to zero in terms of meeting their goals and everyone has to bring loans in the door,” Cohn said. “Banks are going to sharpen their pencils, they’re going to tighten up their margins, and do whatever they can to bring volume in the door and lower rates will bring more real estate transactions.”

Rates won’t drop to 3%

After roughly two years of record-low mortgage rates, the 30-year rate last year increased at their fastest clip in over 50 years. Most of the rate hikes were due to the Federal Reserve’s zealous fight against rampant consumer price growth.

However, signs of cooling inflation in recent months are increasing the likelihood that the Fed will reconsider its pace of hikes – giving mortgage rates a bit of relief. This week new data showed that consumer price growth had dropped to its lowest level in over a year.

Still, rates probably won’t return to levels seen during the early years of the pandemic.

“People can’t expect that we’re going to go back to a 3%, 30-year fixed rate,” Cohn said. “Now that happened because of COVID and the pandemic, and we don’t want to find ourselves in that position again. If we can get interest rates to go back to where they were pre-COVID, call that anywhere from 3.75% to 4.5%, that would be a home run.”

How to get the best interest rate

The combination of higher rates, climbing home prices, and inflation were a massive blow for plenty of first-time buyers last year, who were often priced out of the market.

While a rate drop can significantly boost your buying power, there are other ways you can improve your chances of snagging a lower rate. According to Cohn, the key is to start off early by improving your credit score.

“Many of the banks with better rates are going to want to see someone have three to four different active tradelines on their credit history,” she said, noting buyers should have sufficient money for the down payment plus extra. “We find a lot of first-time homebuyers getting stuck because they maybe have enough money for the down payment, but haven’t taken into consideration all of the closing costs and what you need to have for reserves.”

Another way to soften your rate is by considering an adjustable-rate mortgage or a government-backed home loan, which often carry lower interest rates and may be more accessible.

Finally, keep an eye on the demand in your area. Sellers have been more open to offering incentives, such as mortgage rate buy-downs, cash for closing costs, and even price reductions, so buyers still in the market should jump at those opportunities while they still can.

“When mortgage rates are higher, real estate prices tend to be a little bit softer,” Cohn said. “When interest rates do come dow … real estate prices will start to go back up again and there’ll be more competition for the homes on the market.”

Source: finance.yahoo.com