Consumer prices rose both faster and slower in January.

All that matters is where you draw the line.

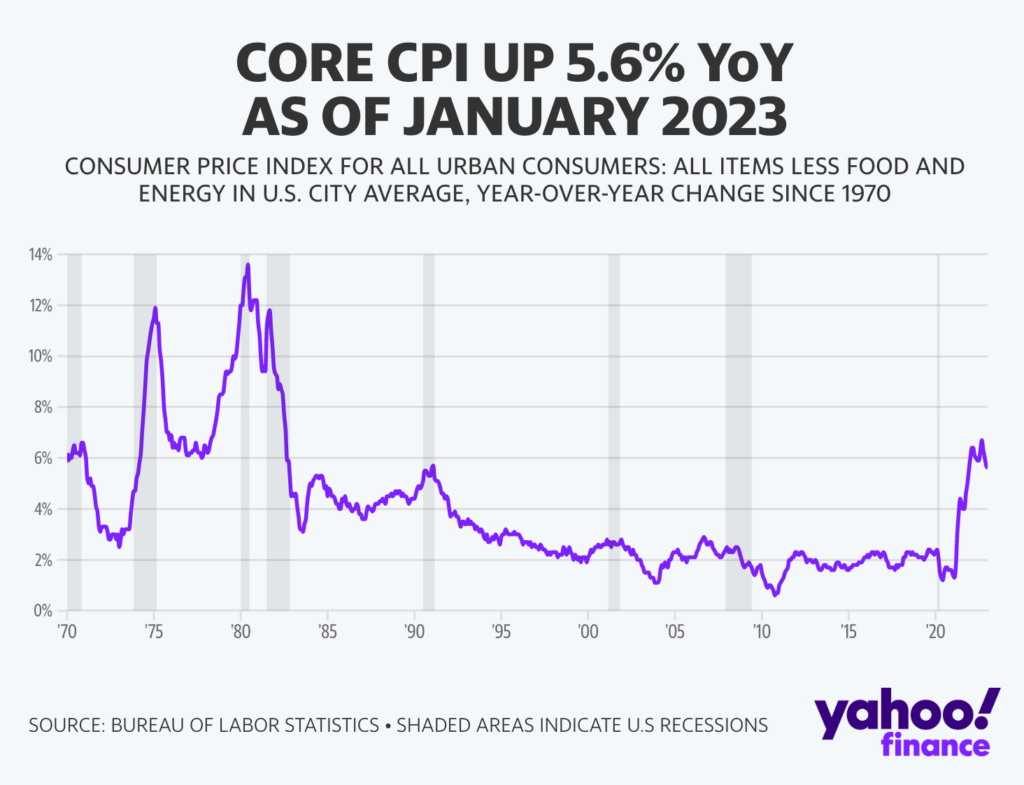

On Tuesday, the Bureau of Labor Statistics’ Consumer Price Index (CPI) for January showed prices rose 0.5% over the prior month to start 2023 and 6.4% over last year on a headline basis.

The monthly increase in headline CPI showed the fastest increase in consumer prices since Oct. 2022; the annual increase marked the slowest increase in prices since Oct. 2021.

On a “core” basis — which strips out food and energy — prices rose 0.4% over last month and 5.6% over last year. This monthly increase marked the fastest rise in core prices since Sept. 2022; the annual increase was the slowest pace of increases since Dec. 2021.

In a word, January’s inflation data was good. In two words, not good.

Of course, the reason investors care so much about inflation is because of what this report may or may not mean for the Federal Reserve.

In the case of Tuesday’s data, this report suggests another 0.25% increase in the Fed’s benchmark interest rate is a near certainty next month. And the likelihood of further action in May just went up, too.

“In our view, inflation is still set to grind lower, but the process is likely to be bumpy and take time,” wrote Wells Fargo economists Sarah House and Michael Pugliese.

“Despite some directional improvement over the past couple of quarters, prices are still growing well-above the Fed’s 2% target, and the tight labor market suggests that there are still inflationary pressures that could forestall a full return to 2% inflation. We continue to look for the FOMC to raise the fed funds rate by another 25 bps at both the March and May meetings and to hold the target range at 5.00%-5.25% through the year’s end to ensure that high inflation will be quelled for good.”

Ian Shepherdson, chief economist at Pantheon Macroeconomics, wrote Tuesday, “this report won’t change anyone’s mind about the inflation picture; both hawks and doves will find something to highlight.”

For the hawks, continued firming in rent prices was the star on Tuesday.

“Housing accounted for roughly half of the total increase in the CPI, which won’t sit well with the Fed,” Ryan Sweet, Chief US Economist. “Rental prices were up 0.7% in January. Though market rents have rolled over, it takes roughly a year for that to feed into the CPI.”

For the doves, the balance of services inflation that excludes rent — or about 60% of that basket — rose at an annualized rate of 1.5% in January, per data from Bespoke Investment Group.

In other words, excluding housing, “core” inflation is running below the Fed’s target.

So while every piece of economic data is available for the kinds of fine-toothed examinations that render firm conclusions elusive, January’s CPI report stands as uniquely — and perhaps divisively — open for for interpretation.

“In our view, there is not a lot of new information in this report,” wrote Michael Gapen, an economist at Bank of America Global Research.

And for markets eager to re-write the status quo with each new piece of data that crosses the wire, there is perhaps no greater challenge than seeing more of the same.

Source: finance.yahoo.com