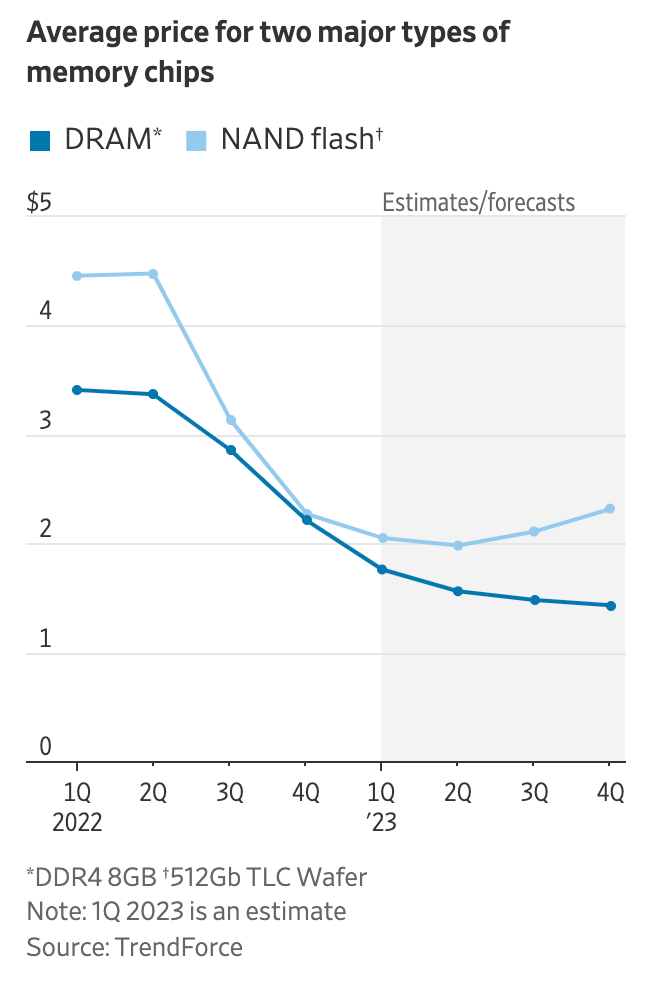

Memory-chip prices, which dropped steeply over the past year, are expected to keep falling in the first half of 2023, putting more pressure on an industry that has already cut investments and jobs.

Average prices for the two main types of memory chips used in everyday electronics—from smartphones to personal computers and TV sets—are projected to experience double-digit percentage declines this quarter, industry analysts say. That comes after prices dropped by more than 20% in the last three months of 2022 from the previous quarter, according to analyst data.

Memory-chip makers, many saddled with large inventories, have also issued grim outlooks as the slump in demand for gadgets persists after a pandemic boom.

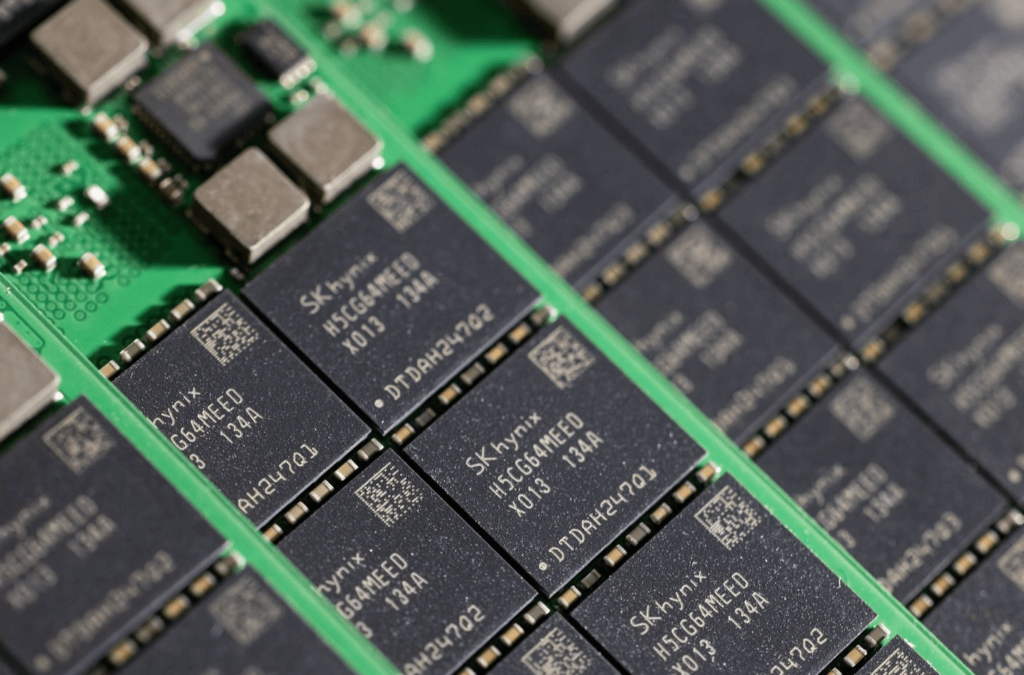

Micron Technology Inc., MU -2.46%decrease; red down pointing triangle SK Hynix Inc., 000660 -0.87%decrease; red down pointing triangle Western Digital Corp. WDC -1.65%decrease; red down pointing triangle and Tokyo-based Kioxia Holdings Corp. have unveiled plans to reduce their investments aimed at capacity expansion or to lower output to address a supply glut that is getting worse. Last month, Micron Technology said it would cut jobs and spending for the year to reduce costs after reporting a loss in its most recent quarter.

Memory chips are considered a bellwether for the semiconductor industry because they are more commoditized and sensitive to shifts in supply and demand.

Samsung Electronics Co., SSNHZ 0.00%increase; green up pointing triangle the world’s largest producer of memory chips, reports earnings Tuesday after saying earlier this month that its operating profit for the October-to-December quarter was expected to drop by 69% from a year earlier to 4.3 trillion won, which is equivalent to roughly $3.5 billion.

SK Hynix, which reports earnings Wednesday, is expected to report a fourth-quarter loss of around 812 billion won, or about $661 million, according to analyst projections averaged by FactSet.

Companies making other types of semiconductors are also caught up in the downturn. On Thursday, Intel Corp. reported a fourth-quarter loss and said poor market conditions would persist through the first half of the year.

Memory prices peaked during the early Covid-19 pandemic due to strong demand for tech products and they began falling in late 2021. Quarter-on-quarter declines got steeper through the second half of last year, as macroeconomic woes and rising interest rates combined with geopolitical uncertainties from the Russia-Ukraine war and China’s Covid lockdowns.

The memory-chip industry started 2023 with high inventories, said Kim Soo-kyoum, associate vice president covering memory semiconductors at International Data Corp., a tech market research firm. With demand still sluggish, memory prices are expected to keep declining throughout this year, though the quarterly drops could narrow or flatten in the second half depending on how soon buyers come back, Mr. Kim said.

Average contract prices for the two main types of memory chips, DRAM and NAND flash, dropped by roughly 23% and 28% respectively during the October-to-December period from the prior quarter, according to TrendForce, a Taiwan-based market researcher that tracks memory prices.

DRAM memory enables devices to multitask, while NAND flash memory provides storage capacity on devices.

Prices for both will likely keep falling through the first half of this year, TrendForce said. DRAM prices are expected to drop—on a quarterly basis—by 20% in the first quarter and 11% in the second quarter, while NAND flash prices during the same time frame are projected to drop by about 10% and 3%, respectively.

Inflation, high interest rates and weak economies are expected to continue to drive pullbacks in corporate and consumer spending on products including smartphones, PCs and data servers that are the biggest users of memory chips, TrendForce said.

DRAM prices are expected to continue dropping through the second half of this year and production cuts on a massive scale would be needed to shore them up, said Avril Wu, a TrendForce senior vice president.

Prices of NAND flash, however, could start to rebound starting in the second half as steeper price falls in recent months had prompted vendors to pursue more aggressive supply cutbacks for 2023, Ms. Wu said.

Samsung, the biggest producer of both types of memory chips, hasn’t publicly committed to moves that could reduce supply. In its last earnings call in October, Samsung’s memory-business Executive Vice President Han Jin-man said the firm was “not considering any artificial reduction in production for the sake of short-term, supply-demand rebalance.”

A Samsung spokeswoman said the company’s stance hasn’t changed.

In a report last month, Goldman Sachs forecast Samsung’s semiconductor unit’s operating profit for the October-to-December quarter would be around 1.5 trillion won, or roughly $1.2 billion, an 83% drop from a year earlier. It also projected Samsung’s memory business would record an operating loss starting from the first quarter of this year due to steep losses in the NAND flash business.

Global tech demand could recover later this year, aided by factors like China’s reopening after a period of strict Covid-19 restrictions which could revive consumer spending on products like smartphones, said David Tsui, senior credit analyst at S&P Global Ratings.

For now, it isn’t clear how quickly and to what extent consumer behavior would change in the country, he said.

Source: finance.yahoo.com