Netflix (NFLX) is set to report fourth quarter financial results after the bell on Thursday as investors seek greater clarity surrounding the streaming giant’s profitability efforts, including its crackdown on password sharing and its recently debuted ad-supported tier.

The Street will also continue to keep a close eye on subscriber numbers, which fell in each of the first quarters of the year, but are expected to grow again in Q4 after rebounding in the third quarter.

Here are Wall Street’s expectations for Netflix’s headline results, according to Bloomberg consensus estimates:

- Revenue: $7.85 billion

- Adj. earnings per share (EPS): $0.58

- Subscribers: 4.5 million net additions

Although foreign exchange headwinds have been a pain point for the streaming giant, a weakening U.S. dollars should help boost revenue and operating income in the fourth quarter, with analysts from Goldman Sachs to Wells Fargo raising estimates for the streaming giant in recent weeks.

Netflix guided to subscriber additions of 4.5 million in October, though some analysts are looking for this figure to beat expectations amid a slew of high-profile and record-breaking content releases, including “Glass Onion,” “Troll,” “All Quiet on the Western Front,” “My Name is Vendetta,” and “Wednesday.”

Analysts at JPMorgan, for instance, are forecasting 4.75 million net paid additions for the company in its most recent quarter.

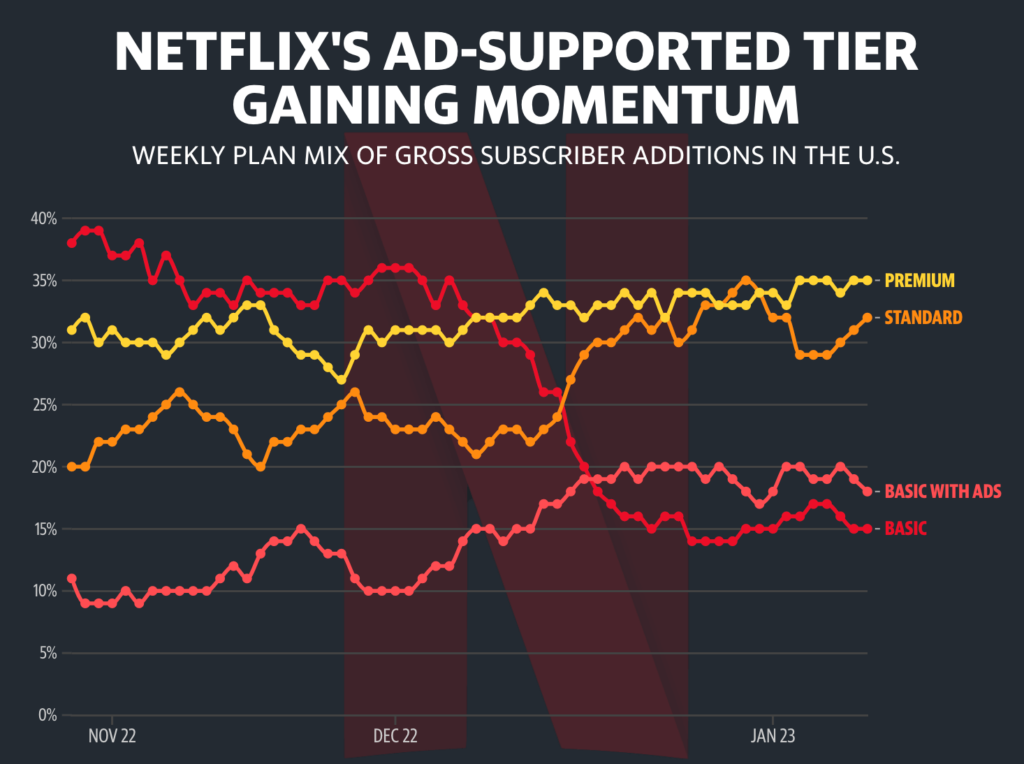

Investors will not see the full impact of Netflix’s foray into advertising within Thursday’s results given the tier just launched in November. However, data from third-party research firm YipitData points to increased momentum.

According to that data, Netflix’s ad tier has been modestly incremental to positive subscriber trends, and has not driven significant cannibalization of the standard and premium tiers — a previous concern on the Street.

Ad-based gross adds have gained traction throughout the quarter, comprising roughly 15% of total subscriber gross adds, YipitData added.

Overall, analysts have preached the long game to investors when it comes to advertising, with Wells Fargo’s Steve Cahall anticipating password sharing will be a bigger topic in the near-term.

“While much of the sellside and buyside focus of late has been the [advertising video-on-demand] launch, we actually think disclosure will be limited as will the impact on estimates. Instead, we think password sharing is the bigger catalyst near term,” Cahall wrote in a new note to clients. “As the Street better understands password sharing we see it as upside to revenue growth estimates.”

Netflix shares have been on a tear in recent weeks, up more than 60% over the past six months with a more than 10% gain so far in January, outperforming the Nasdaq Composite’s 5% gain.

Source: finance.yahoo.com