A Roth IRA can be a great place to stash your retirement savings. Unlike a traditional IRA, you won’t have to pay income tax on the money you withdraw or be required to take a minimum amount from your account each year after you reach a certain age.

These retirement accounts are available to just about everyone. While you can’t contribute to a Roth IRA if your income exceeds the limits set by the IRS, you can convert a traditional IRA into a Roth—a process that’s sometimes referred to as a “backdoor Roth IRA.”Read on to learn about Roth IRA conversion rules that you may be able to use.

Roth IRA Conversion Rules

Converting all or part of a traditional IRA to a Roth IRA is a fairly straightforward process. The IRS describes three ways to go about it:

- A rollover, in which you take a distribution from your traditional IRA in the form of a check and deposit that money in a Roth account within 60 days

- A trustee-to-trustee transfer, in which you direct the financial institution that holds your traditional IRA to transfer the money to your Roth account at another financial institution

- A same-trustee transfer, in which you tell the financial institution that holds your traditional IRA to transfer the money into a Roth account at that same institution

Of these three methods, the two types of transfers are likely to be the most foolproof. If you take a rollover and, for whatever reason, don’t deposit the money within the required 60 days, you could be subject to regular income taxes on that amount plus a 10% penalty. The 10% penalty tax doesn’t apply if you are over age 59½.

Whichever method you use, you will need to report the conversion to the IRS using Form 8606: Nondeductible IRAs when you file your income taxes for the year.

Tax Implications of Converting to a Roth IRA

When you convert a traditional IRA to a Roth IRA, you will owe taxes on any money in the traditional IRA that would have been taxed when you withdrew it. That includes the tax-deductible contributions you made to the account as well as the tax-deferred earnings that have built up in it over the years. That money will be taxed as income in the year you make the conversion.

Roth Conversion Limit

At present, there are essentially no limits on the number and size of Roth conversions you can make from a traditional IRA. According to the IRS, you can make only one rollover in any 12-month period from a traditional IRA to another traditional IRA. However, this one-per-year limit does not apply to conversions where you do a rollover from a traditional IRA to a Roth IRA.

So if you wish, you can roll over all your tax-deferred savings at once. However, this approach is generally not advisable because it could push some of your income into a higher marginal tax bracket and result in an unnecessarily hefty tax bill.

Usually, it’s wise to execute the conversion over several years and, if possible, convert more in years when your income is lower. Adopting this strategy could result in paying less tax on each additional dollar of converted money. Stretching transfers out may also reduce the risk that your taxable earnings will be too high for you to qualify for certain government programs.

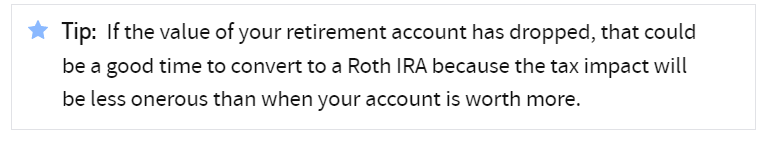

Another good time to convert: when the stock market is in bad shape and your investments are worth less.

Backdoor Roth IRAs

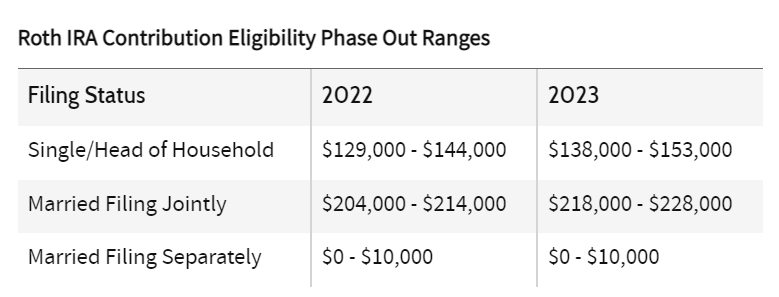

In 2022, Roth IRA contributions were capped at $6,000 per year, or $7,000 per year if you were 50 or older. For 2023, maximum Roth IRA contributions are $6,500 per year, or $7,500 per year if you are 50 or older. These limits do not apply to conversions from tax-deferred savings to a Roth IRA.

In addition, people whose incomes exceed a certain amount may not be eligible to make a full (or any) contribution to a Roth.

However, people in that situation can still convert traditional IRAs into Roth IRAs—the strategy known as a “backdoor Roth IRA.”

Beware of the 5-Year Rule

One potential trap to be aware of is the so-called “five-year rule.” You can withdraw regular Roth IRA contributions tax- and penalty-free at any time or any age. Converted funds, on the other hand, must remain in your Roth IRA for at least five years. Failure to abide by this rule will trigger an unwelcome 10% early withdrawal penalty.

The five-year period starts at the beginning of the calendar year that you did the conversion. So, for example, if you converted traditional IRA funds to a Roth IRA in November 2022, your five-year clock would start ticking on Jan. 1, 2022, and you’d be able to withdraw money without penalty anytime after Jan. 1, 2027.

Remember, this rule applies to each conversion, so if you do one in 2023 and another in 2024, the latter transfer will need to be held in the account for a year longer to avoid paying a penalty.

Does a Roth IRA Conversion Make Sense for You?

When you convert from a traditional IRA to a Roth, there’s a tradeoff. You will face a tax bill—possibly a big one—as a result of the conversion, but you’ll be able to make tax-free withdrawals from the Roth account in the future.

One reason that a conversion might make sense is if you expect to be in a higher tax bracket after you retire than you are now. That could happen, for example, if your income is unusually low during a particular year (such as if you’re laid off or your employer cuts back on your hours) or if the government raises tax rates substantially in the future.

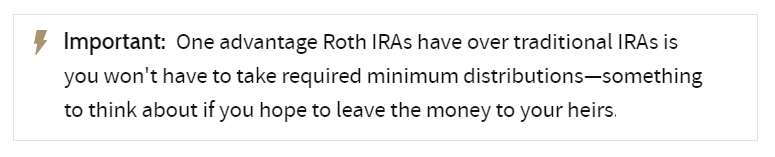

Another reason that a Roth conversion might make sense is that Roths, unlike traditional IRAs, are not subject to required minimum distributions (RMDs) after you reach age 73 (starting in 2023) or 75 (starting in 2033). So, if you’re fortunate enough not to need to take money from your Roth IRA, you can just let it continue to grow and leave it to your heirs to withdraw tax-free someday.

Moreover, you can continue to contribute to your Roth IRA regardless of your age, as long as you’re still earning eligible income. Since January 2020, you can also keep contributing to a traditional IRA (previously you had to stop at age 70½).

How Much Tax Will I Pay If I Convert My Traditional IRA to a Roth IRA?

Traditional IRAs are generally funded with pretax dollars; you pay income tax only when you withdraw (or convert) that money. Exactly how much tax you’ll pay to convert depends on your highest marginal tax bracket. So, if you’re planning to convert a significant amount of money, it pays to calculate whether the conversion will push a portion of your income into a higher bracket.

Is There a Limit to How Much You Can Convert to a Roth IRA?

You can convert as much as you like from a traditional IRA to a Roth IRA, although it’s sometimes wise to spread these transfers out for tax purposes.

What Happens When You Convert to a Roth IRA?

When you convert a traditional IRA to a Roth IRA, you pay taxes on the money you convert in order to secure tax-free withdrawals as well as several other benefits, including no required minimum distributions, in the future.

What Is the Downside of Converting From a Traditional IRA to a Roth IRA?

The most obvious downsides are the hit to your current tax bill—your IRA withdrawal amount will count as taxable income for that year—and that you can’t touch any of the money you convert for at least five years—unless you pay a penalty.

The Bottom Line

Converting a traditional IRA or funds from a SEP IRA or SIMPLE plan to a Roth IRA can be a good choice if you expect to be in a higher tax bracket in your retirement years. To reduce the tax impact as possible, it may be advisable to split conversions of large accounts over several years or wait until your income or the assets’ values are low. Either way, converting your investments to a Roth allows your earnings to grow and eventually be distributed tax-free, potentially saving you thousands of dollars in the long run.

Source: investopedia.com