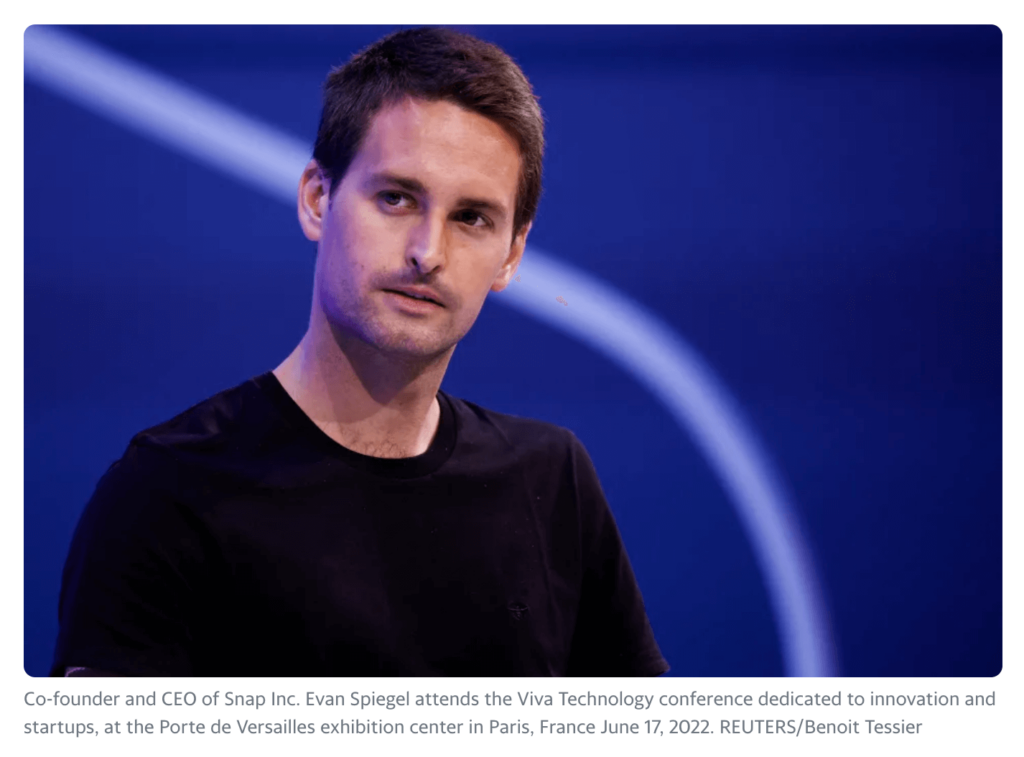

Snap (SNAP) held its second-ever Investor Day on Thursday just weeks after another brutal quarterly report that sent shares tumbling.

CEO Evan Spiegel’s message to investors on Thursday focused on monetization, the growth of Snap’s community, the appeal of Snap’s demographic and platform to advertisers, and, of course, augmented reality (AR). And a big number — one billion users.

At the company’s Santa Monica, Calif. headquarters, Snap revealed its monthly active user base has expanded to 750 million monthly active users (MAUs), a 25% increase from 600 million MAUs 10 months ago.

The company added it sees a path to getting that MAU number to 1 billion in the next couple of years.

Meanwhile, Snap’s daily active users (DAU) currently clock in at about 375 million.

“We have everything we need to build a successful business over the long-term, a large and growing community, an innovative and engaging product that continues to evolve, a strong balance sheet with a track record of positive free cash flow and a long-term vision for what we believe will be the most meaningful advancements in computing that the world has ever seen — augmented reality,” CEO Evan Spiegel told the audience.

On Jan. 31, Snap reported fourth quarter results, meeting analyst estimates for revenue and user growth, but showing a net loss and weak first quarter guidance.

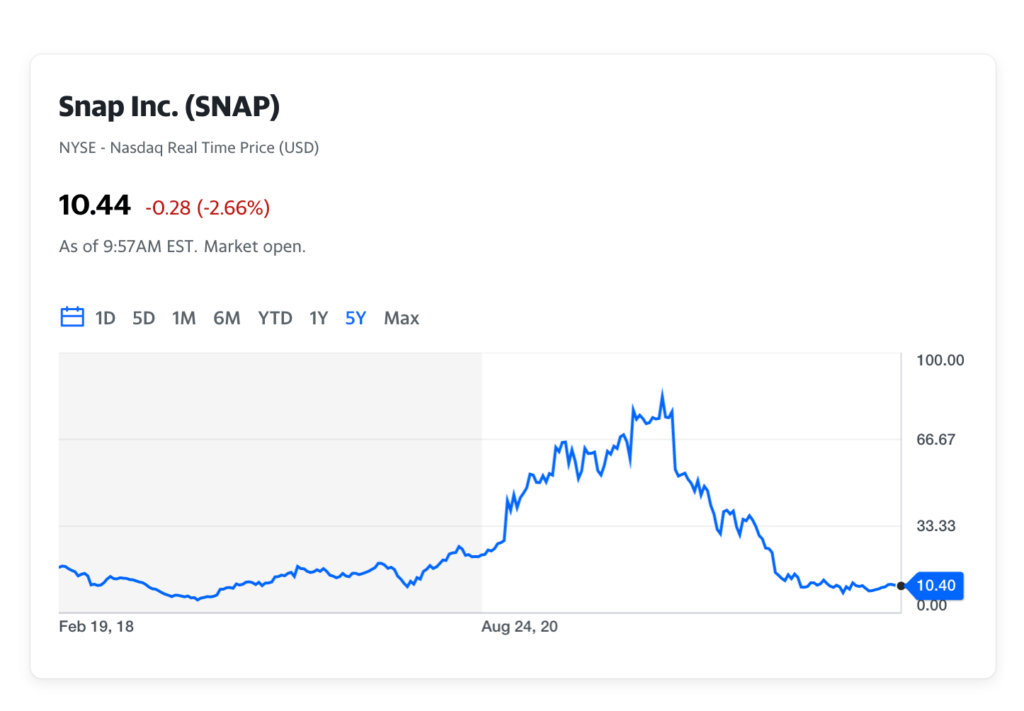

Snap shares fell 4.7% on Thursday following its investor day. Still, shares are up about 20% so far this year. From its record high reached in 2021, shares are down about 85%.

AR’s still the long-term plan

Though generative AI has surged in popularity in recent months — and competitor Meta Platforms (META) has been aggressively pursuing its own metaverse-centered vision of the future — Snap co-founder and CEO Evan Spiegel is sticking to his guns.

“Augmented reality has the potential to make nearly everything in our daily lives better, whether discovering the storied history of your neighborhood, learning to play piano, re-decorating your living room or practicing your football spiral,” he said.

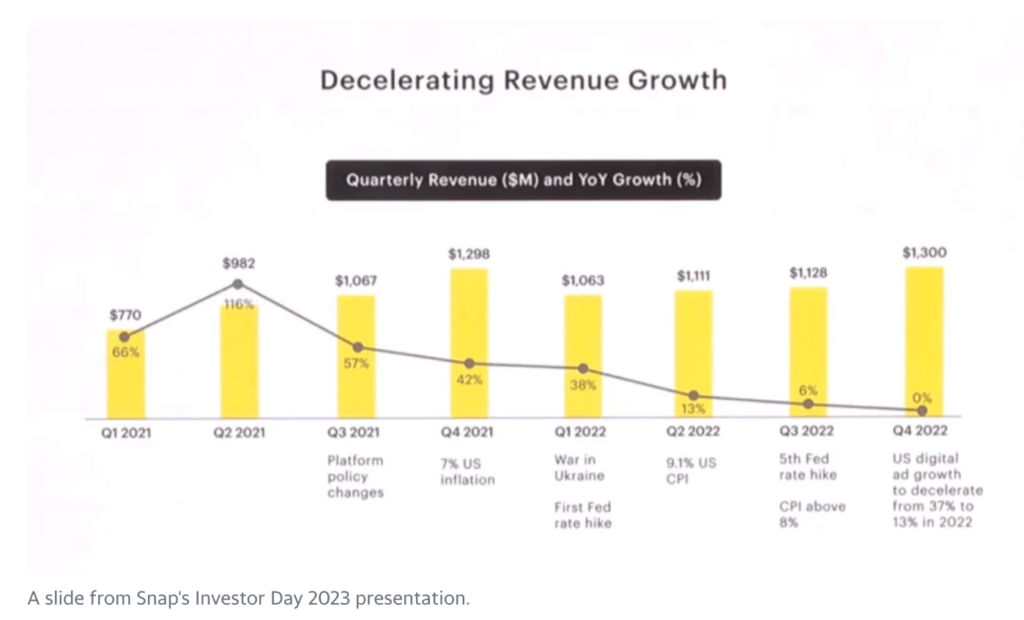

Snap’s decelerating revenue growth

Snap CFO Derek Andersen emphasized the difficulties of the macroeconomic climate, and how it’s affected Snap’s top and bottom line. He acknowledged in the Q&A session the company needs to boost its top line to set things right, but added the company is focusing on what it can control, rather than the macro and privacy changes that have rattled it over the last year and a half.

Last month, Snap guided to current quarter revenues dropping between 2%-10% from a year ago.

“We’re going to stay focused on the inputs we can control and hope that the environment cooperates,” he added.

Looking at the near-term, Andersen expressed optimism about the company’s direct response ads business and ability to monetize its AR capabilities.

In the medium-term, plans include leveraging and growing its subscription service, Snapchat Plus.

“We want to prioritize the opportunities we’re going to go after,” Andersen said. “We want to fully fund those priorities, then it’s all about execution.”

Source: finance.yahoo.com