Sports betting broke records in 2022, according to new data released by the American Gaming Association (AGA).

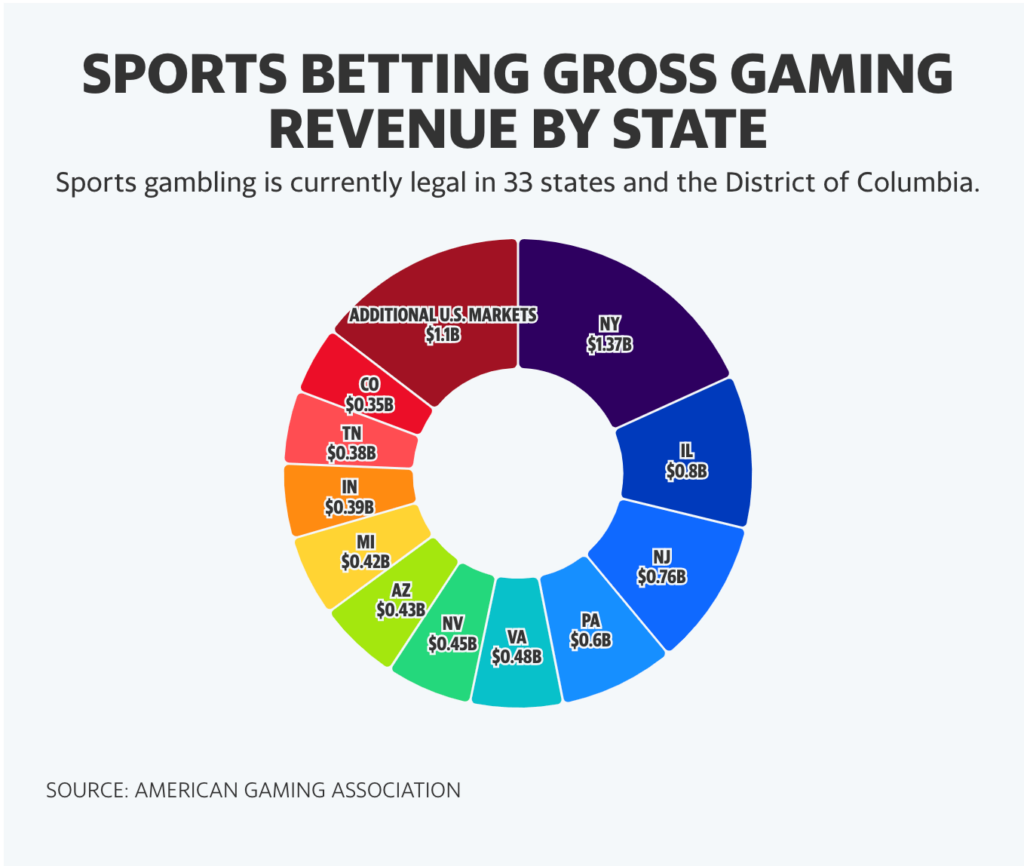

According to the AGA findings, sports betting gross game revenue hit a record $7.5 billion last year, a nearly 75% increase from 2021, while total gross gaming revenue (GGR), which accounts for all legal gambling, exceeded $60 billion for the first time ever.

“Our industry significantly outpaced expectations in 2022,” AGA President and CEO Bill Miller said. “Simply put, American adults are choosing casino gaming for entertainment in record numbers, benefiting communities and taking market share from the predatory, illegal marketplace.”

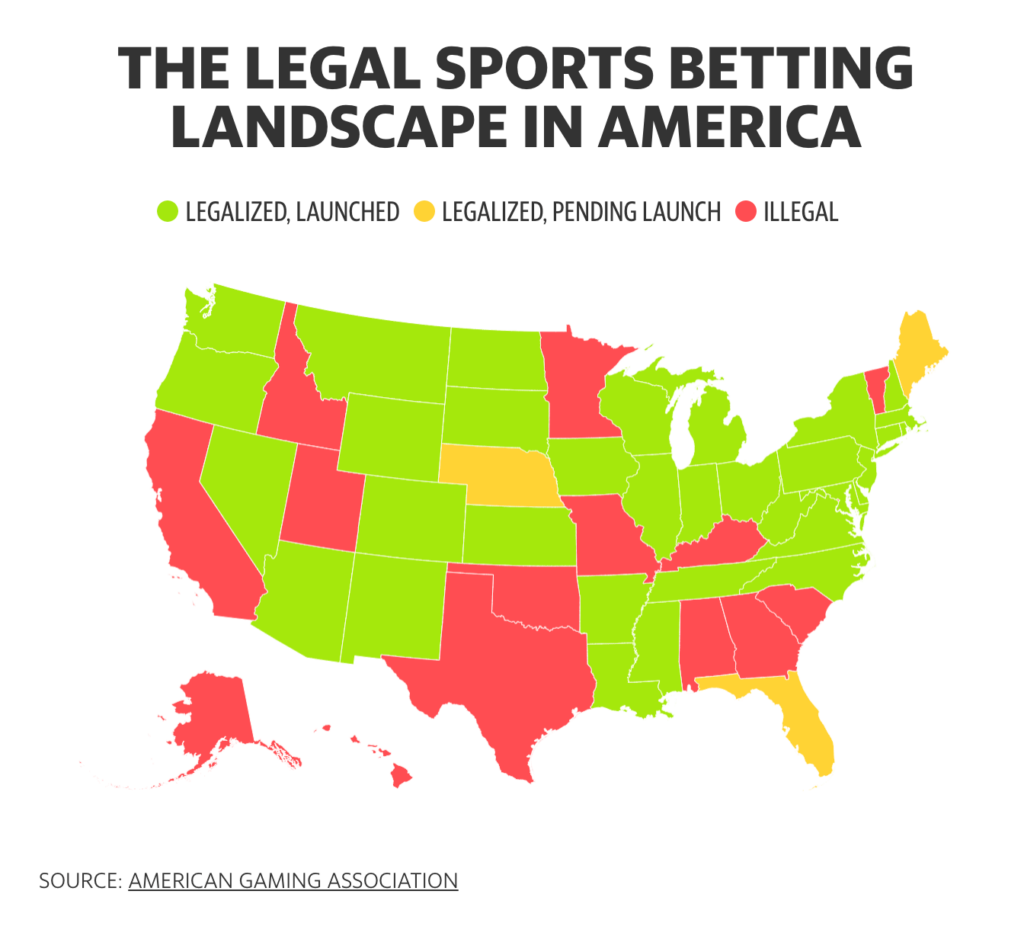

Increased legalization, including the addition of four new mobile gambling states and the maturation of previously legal markets, drove the higher revenue numbers, according to the AGA.

Currently, sports gambling is legal in 33 states and the District of Columbia while eight states have active legislation to legalize it. Texas is among those states and would become the largest destination for legal sports betting if its bill passes.

That momentum hasn’t entirely gained steam across the U.S., though: In 2022, California, one of the sports gambling industry’s most sought-after markets, failed to pass legislation to legalize sports gambling.

“Legalization has definitely slowed down,” topld Christopher Lynch, Citizens Capital Markets head of gaming leisure investment banking. “That’s just a function of how many states have legalized. We’re at about 35 states that have legalized in some form or fashion. I think that’s gonna continue to remain a focus, with Texas being the biggest focus.”

While sports betting led the largest yearly increase in GGR, which is the amount casinos earn prior to paying state taxes, other sectors of the gaming industry also significantly increased in 2022, according to the report.

Slot revenue ($34.19 billion) increased marginally, while table game revenue ($10 billion) and iGaming revenue ($5.02 billion) both experienced double-digit growth from 2021.

Over the past year, Wall Street has been focused not just on the eye-popping revenue numbers in the gambling space but also on how much operators are spending to acquire their boosted revenue.

Marketing spend in sports gambling has hampered many casino operators from posting profitable quarters in their online gambling units amid a broader trend of risk-off trades in markets.

Online gambling operator DraftKings (DKNG), which reported an Adjusted EBITDA loss of $326.29 million in the fourth quarter of 2021, is set to report earnings for the fourth quarter of 2022 on Thursday after the market close.

Wall Street is expecting DraftKings to report a loss of $112.42 million.

“The outlook’s all about: Are they able to go and be able to prove to the Street that they can actually generate and grow this business profitably?” told Jed Kelly, Oppenheimer managing director of equity research for consumer internet. “They’ve got a pretty good outlook for state launches this year, so that should allow them to leverage their advertising spend better.”

Source: finance.yahoo.com