EV stocks have multiplied in Tesla’s (TSLA) wake and as electric cars look to go mainstream — but not all are created equal. Some car stocks are more ready than others for an electric future. Here are the top-rated EV makers and EV-related plays.

Best EV Stocks To Buy Or Watch

The charts of most EV stocks remain under strain. Broadly, both established automakers and startups are a speculative bet on the growth of electric vehicles, itself seen as a nascent field. Growth stocks led the bear market in 2022 due to rising inflation and interest rates.

It’s hard to find an EV stock with a good mix of fundamentals and technicals right now. Not including Tesla, these are our picks based on EV sales, strategy and growth plans.

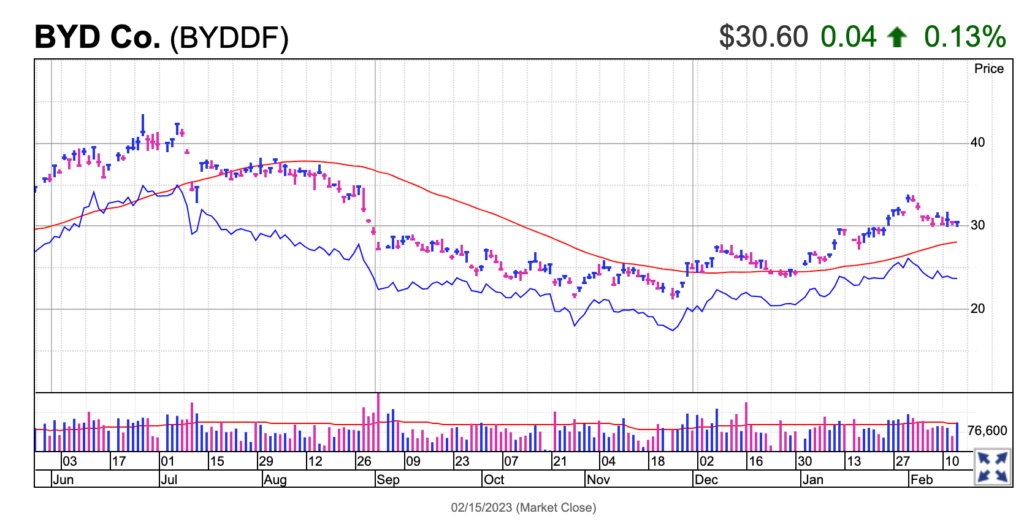

BYDDF Stock

BYD (BYDDF) earns an EPS Rating of 83 and RS Rating of 75, both out of a best-possible 99. The 75 RS Rating means that BYDDF stock has outperformed 75% of all stocks in IBD’s database over the past year. Shares trade over the counter in the U.S.

BYD stock is working on a long, deep cup base with a buy point of 43.71. Shares appear to be working on a handle above the 200-day line that might be fractionally too low to be a proper handle.

In early 2022, China auto giant BYD (for Build Your Dreams) switched to producing only all-electric vehicles (also known as battery electric vehicles, or BEVs) and plug-in hybrid electric vehicles (PHEVs).

BYD sold more than 1.85 million electric cars in 2022, including hybrids. In 2022, as well as in 2021, BYD more than tripled EV sales.

Most of BYD’s sales are still on home turf. However, it has a big international expansion underway, including the U.S., Europe and markets in Asia beyond China.

The company supplies batteries, including to Tesla, and makes its own chips. That has underpinned BYD’s rapid expansion in 2021 and 2022.

Including PHEVs, BYD has surged past Tesla sales. BYD is closing the gap with Tesla on BEVs as well. In the minus column, investing legend Warren Buffett continues to cut his stake in BYDDF shares.

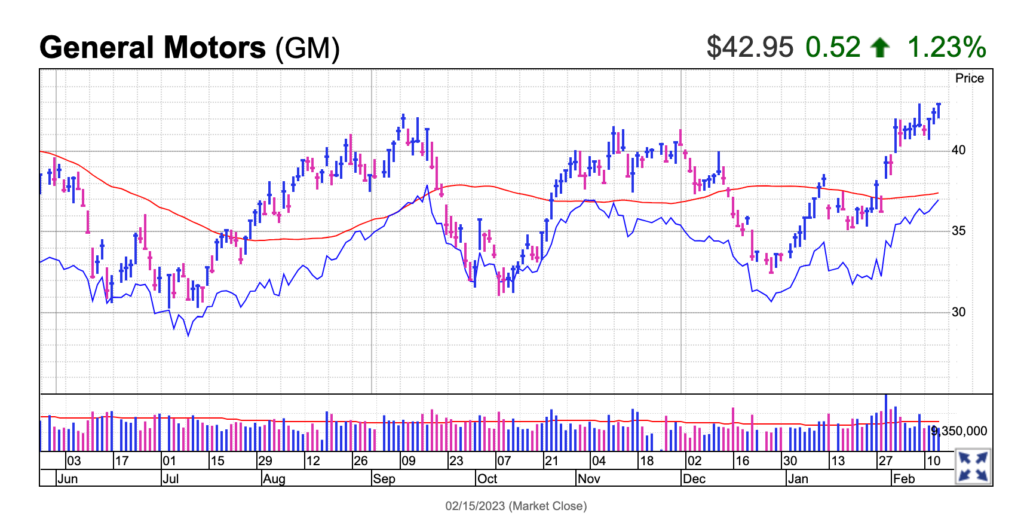

GM Stock

General Motors (GM) has a Composite Rating of 84, EPS Rating of 83 and RS Rating of 71. GM stock is well above the 21-day moving average, as well as longer-term averages, after better-than-expected earnings and strong outlook.

GM stock cleared a 41.68 buy point Feb. 13. It’s within the 5% chase zone, which goes to 43.76.

Along with earnings Jan. 31, GM CEO Mary Barra announced a $650 million investment in Vancouver, British Columbia-based Lithium Americas (LAC). Lithium is a key EV battery material.

Traditional automakers continue ramping up on electric vehicles (EVs), away from gas and diesel cars. Through 2025, General Motors is spending $35 billion to develop electric and autonomous vehicles. It aims to launch 30 new EVs around the world by then. By 2030, GM expects as much as half its global sales to be battery-powered cars.

In the minus column, GM has struggled to ramp up production of luxury new EVs, including the Hummer truck and Lyriq SUV, though its older-generation Chevy Bolt EV model is selling well.

Three all-new EV models are due in 2023 from GM’s mass-market Chevrolet brand. Those new EVs include all-electric versions of the Chevrolet Silverado, Chevrolet Blazer and Chevrolet Equinox. The Chevy Silverado pickup is GM’s top-selling model. The Blazer and Equinox are popular SUVs.

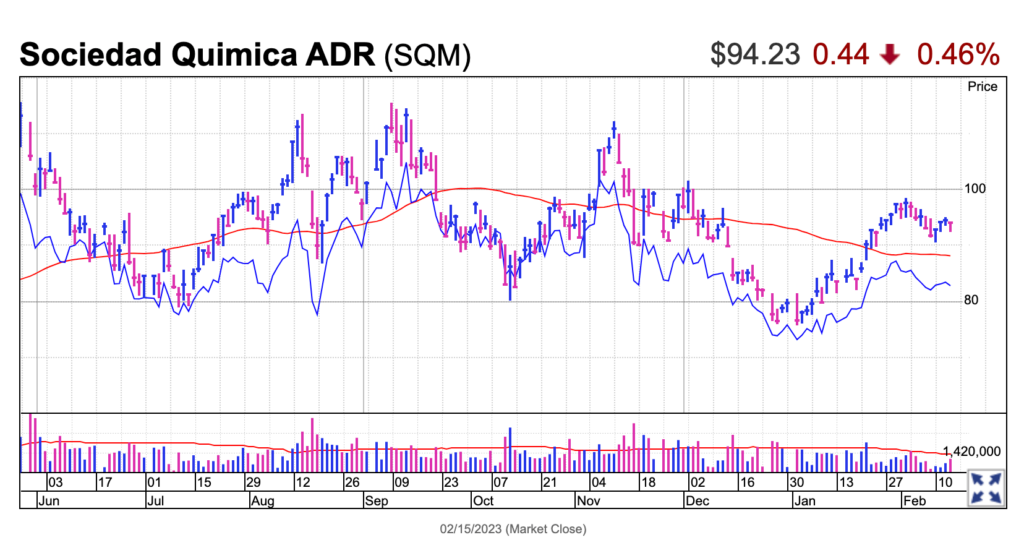

SQM Stock

Sociedad Quimica y Minera (SQM), also known as SQM, carries a 93 Composite Rating, 96 EPS Rating and 77 RS Rating.

SQM stock has a double-bottom base with a 112.45 buy point, but is carving a handle that could lower the official entry to 98.76.

Chile’s SQM is riding the global adoption of electric vehicles, which use lithium batteries. Demand for lithium, a critical EV battery material, has been outpacing supplies. That has sent lithium prices soaring.

SQM also produces iodine and potassium, used in X-rays and fertilizers respectively.

ON Stock

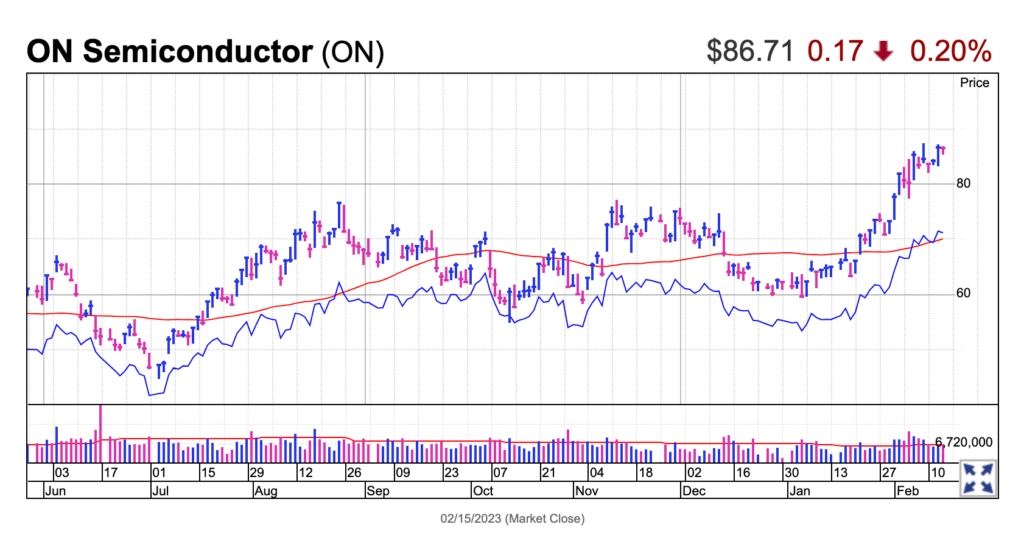

Onsemi (ON) carries a Composite Rating of 95, EPS Rating of 93 and RS Rating of 94. On Feb. 1, ON stock broke out of a cup base with a buy point of 77.38.

Shares have kept rising and are now extended, meaning they are not within the proper 5% buy range.

The chipmaker beat estimates for the fourth quarter Feb. 6, but fell on weak guidance. ON stock remains above the buy point.

The secular megatrends of electric vehicles, advanced driver-assistance systems, alternative energy and industrial automation drove Onsemi’s revenue growth, CEO Hassane El-Khoury said in a news release.

Earlier in January, Onsemi entered into a strategic partnership with Volkswagen (VWAGY) to supply inverters for use in a next-generation VW electric platform.

Onsemi also provides technology for fast charging electric vehicles.

AEHR Stock

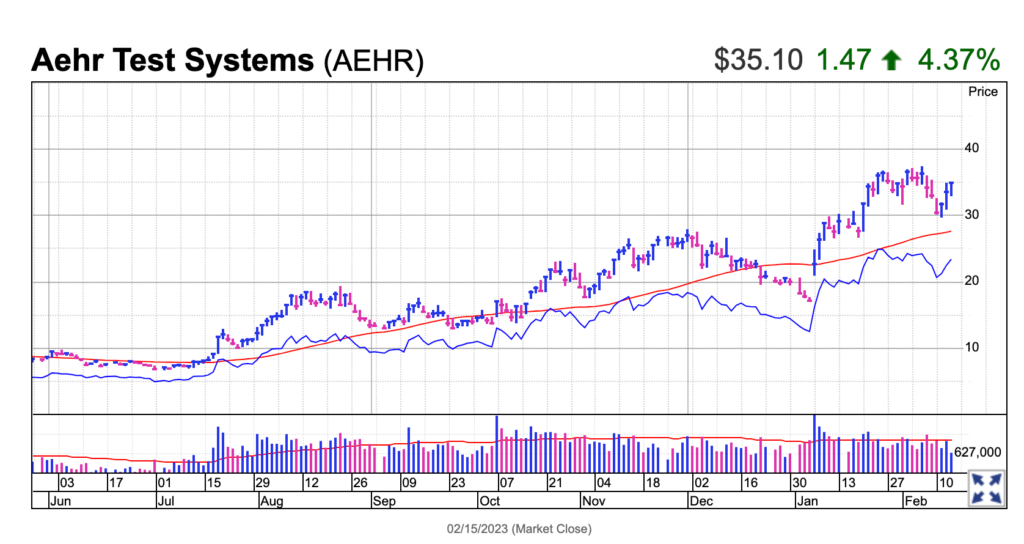

Aehr Test Systems (AEHR) carries a Composite Rating of 99, EPS Rating of 78 and RS Rating of 99, all out of a best-possible 99.

AEHR stock has had big swings in the past several months, usually up.

Semiconductor equipment maker Aehr offers products for testing logic, optical and memory integrated circuits, as quality and reliability needs increase. The Fremont, Calif.-based company has been growing revenue by double and triple digits.

It touts strong demand for gear to test silicon carbide power chips used in electric vehicles.

The demand for silicon carbide (SiC) EV chips is seen increasing exponentially in the decade ahead.

In addition to EVs, silicon carbide chips have bright prospects in industrial, solar, wind, and EV charging infrastructure markets.

Are EV Stocks A Good Buy?

Companies with two characteristics generally make the best candidates for stocks to buy and watch, according to CAN SLIM guidelines. First, they need a strong track record of earnings growth. Second, they should be technically strong and be shaping bullish chart patterns.

Most of the new EV startups have neither. Those EV stocks include Fisker (FSR), Canoo (GOEV), Faraday Future (FFIE), Lordstown (RIDE) and Xos (XOS). In fact, many of the startups aren’t producing electric vehicles yet.

However, Lucid Motors (LCID) and Rivian Automotive (RIVN) have begun selling EVs.

Meanwhile, Chinese EV startups like Nio (NIO), XPeng (XPEV) and Li Auto (LI) sell tens of thousands of vehicles, but aren’t yet or aren’t consistently profitable.

Then there are legacy auto giants like General Motors (GM), Ford (F), Volkswagen (VWAGY) and China’s BYD Co. (BYDDF), all transforming into EV powerhouses.

EV Battery Stocks, EV Charging Stocks

The growing universe of EV stocks doesn’t end with carmakers. A constellation of other companies provide car batteries, car charging stations, electric motors and other EV-related products. Among them are ChargePoint (CHPT), EVgo (EVGO), Blink Charging (BLNK) and Wallbox (WBX).

Hyliion (HYLN) is developing electric powertrains for big-rig trucks. Romeo Power (RMO) makes battery packs for commercial EV fleets. QuantumScape (QS) targets solid-state lithium metal batteries.

Magna (MGA) supplies battery enclosures and e-drive gearboxes. It’s also an EV contract manufacturer.

Source: finance.yahoo.com